Build Wealth By Reducing Mortgage Interest

What if you could pay off your mortgage in just a fraction of the time of a traditional mortgage?

Why Choose Us

BUILD WEALTH

Greg Sandler's mission is to help you build wealth through real estate. The easiest way to do that is to reduce the amount of interest you pay the bank!

YOUR TRUSTED ADVISOR

With over 22 years experience as a top 1% mortgage originator nationwide, Greg Sandler has seen just about every situation and will be your guide.

AVAILABILITY

For over 22 years Greg Sandler has created raving fans by being available to his clients. He makes it easy to connect, just use the booking link here!

Stop overpaying on your mortgage interest and make your money work for you!

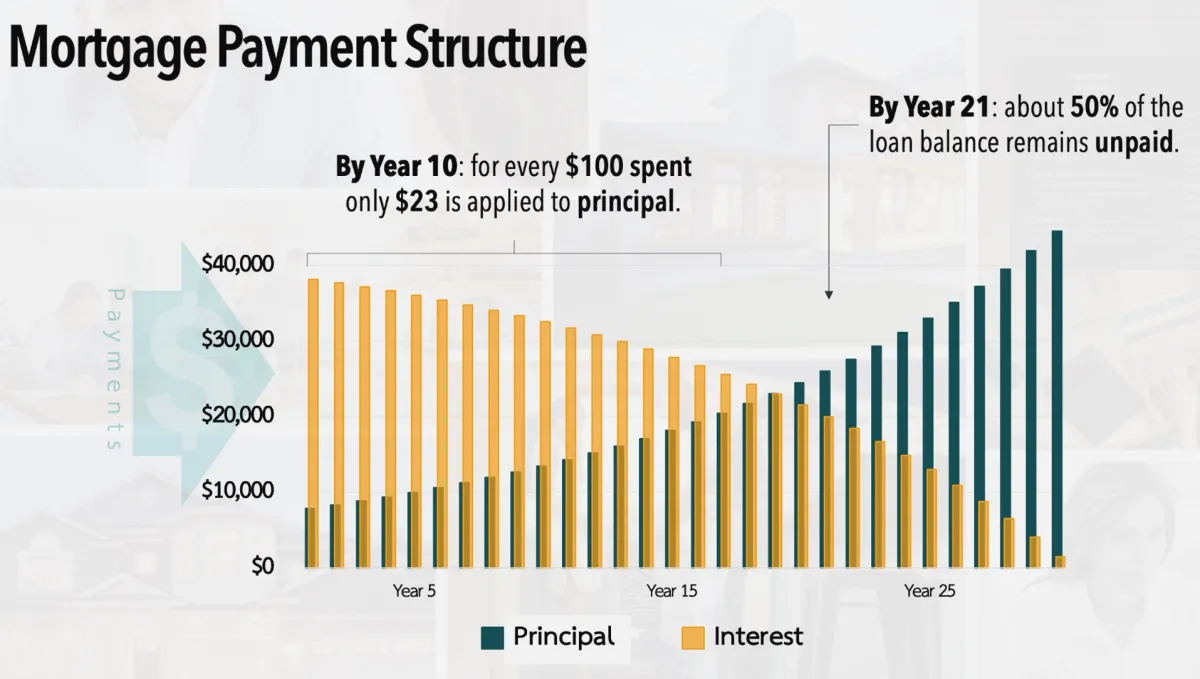

Traditional 30 Year Fixed

With a traditional amortization schedule, interest is front-loaded.

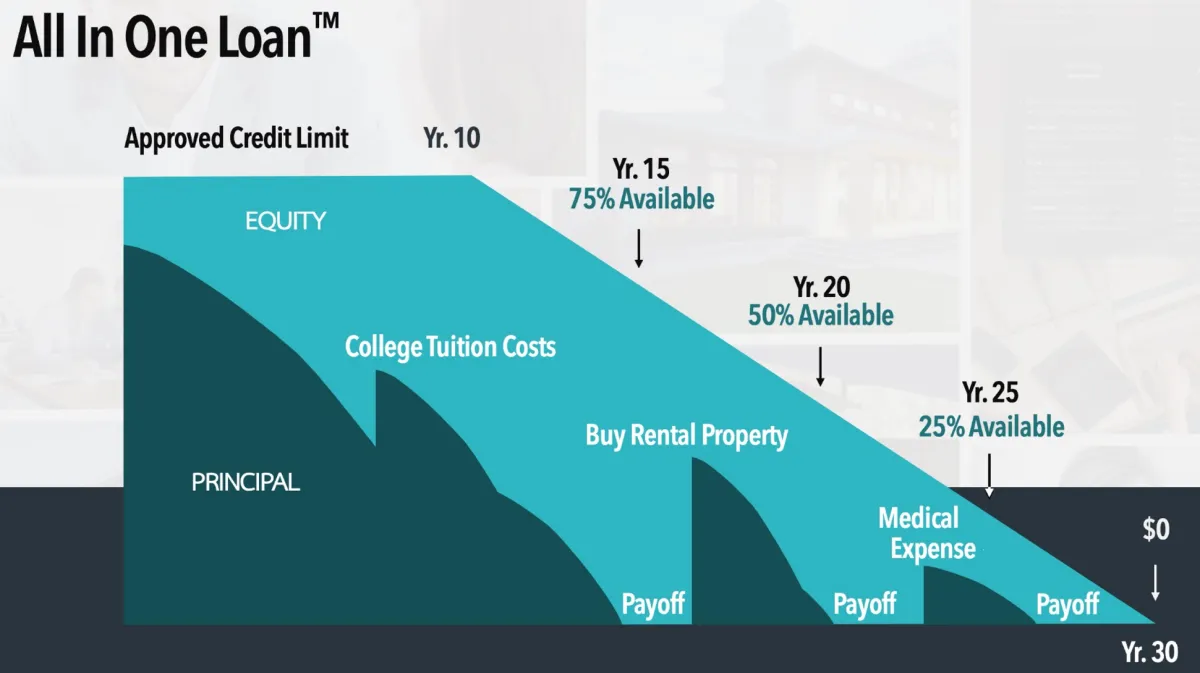

All In One Loan

With the All In One Loan, interest is paid down faster, building equity and wealth.

Testimonials

Contact Us To Discover

How You Can

Build Wealth Through Real Estate

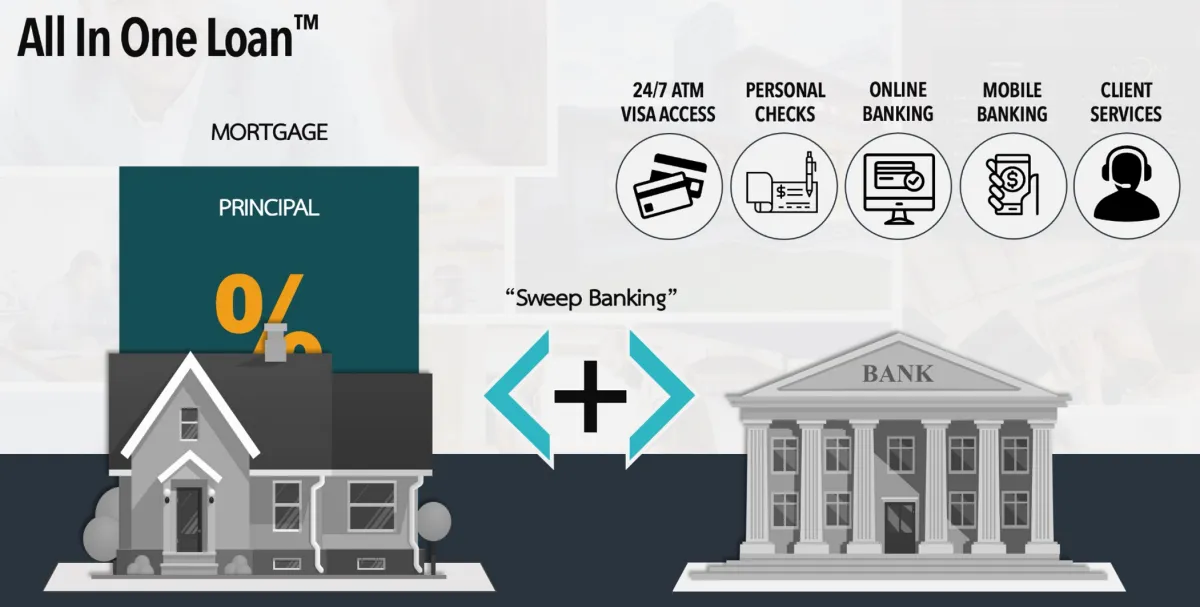

The All In One Loan

Combines Your Mortgage With A Checking Account

Benefits Of The

All In One Program

Quicker Equity Build-Up: By applying income directly to the mortgage principal, homeowners can build equity faster than traditional mortgages.

Interest Savings:The unique structure can lead to substantial interest savings over the life of the loan because the Lender calculates interest on a reduced principal.

Increased Financial Flexibility:The ability to easily access home equity and integrate mortgage and banking features offer unparalleled financial flexibility.

Our Corporate Partners

Contact Greg Sandler

To See How We Can Reduce Your Mortgage Interest And Help You Grow Wealth Through Real Estate

Frequently Asked Questions

What is an All-In-One Mortgage?

An All-In-One Mortgage is a flexible loan product that combines the mortgage with the convenience of a checking account. This setup allows borrowers to use their deposits to reduce the loan’s principal balance, potentially saving on interest over the life of the loan.

How does an All-In-One Mortgage save on interest?

By depositing income directly into the mortgage account, the principal balance is reduced immediately, which means interest is calculated on this reduced balance. Over time, this can lead to significant interest savings compared to traditional mortgages, where interest is calculated on the initial principal for a longer period.

Can I access my home equity with an All-In-One Mortgage?

Yes, one of the key benefits of an All-In-One Mortgage is the ability to access your home equity easily. It functions much like a checking account, allowing you to withdraw the funds you’ve paid over the principal balance when needed.

Is an All-In-One Mortgage suitable for first-time homebuyers?

While an All-In-One Mortgage can be advantageous, it requires disciplined financial management. First-time home buyers should assess their ability to manage fluctuating expenses and their comfort with the loan’s features before deciding.

How does the interest rate on an All-In-One Mortgage compare to traditional mortgages?

Interest rates on All-In-One Mortgages are often variable, meaning they can fluctuate over time. This is different from traditional fixed-rate mortgages where the interest rate remains fixed throughout the loan term.

What happens if I deposit more than my monthly income into my All-In-One Mortgage account?

Any additional funds deposited will further reduce your principal balance, potentially leading to faster equity build-up and additional interest savings.

Are there any penalties for early payoff of an All-In-One Mortgage?

Typically, All-In-One Mortgages do not have prepayment penalties. However, it’s important to review the specific terms of your loan agreement as policies may vary between lenders.

How does an All-In-One Mortgage impact my credit score?

Like any mortgage, an All-In-One Mortgage can impact your credit score. On-time payments can have a positive effect, while late payments can negatively impact your score.

Can I use an All-In-One Mortgage for investment properties?

All-In-One Mortgages are generally designed for primary residences. The availability for use on investment properties may vary by lender and should be confirmed with your financial institution.

What are the tax implications of an All-In-One Mortgage?

The interest paid on an All-In-One Mortgage may be tax-deductible, similar to traditional mortgages. However, tax laws are complex and can change, so it’s advisable to consult with a tax professional for personalized advice.

How does refinancing work with an All-In-One Mortgage?

Refinancing an All-In-One Mortgage would typically involve replacing it with a different mortgage product. The decision to refinance should be based on current interest rates, financial goals, and the terms of the new loan.

What should I consider before applying for an All-In-One Mortgage?

Consider your financial stability, your ability to manage a variable interest rate, and whether the flexible nature of the loan aligns with your long-term financial goals. Consulting with a mortgage advisor is recommended.

Are All-In-One Mortgages available from all lenders?

Not all lenders offer All-In-One Mortgages. It’s a specialized product.

About Us

At USA Lending, we aim to humbly serve our communities and help people achieve their dreams. We believe everyone deserves the opportunity to own a home and are committed to providing expert guidance and personalized solutions to make that a reality.

USA Lending is Powered By Texana Bank

Company NMLS: 407536

Member FDIC – Equal Housing Lender

Copyright © 2023 USA Lending. All rights reserved.